| Best CD Rates with FDIC |

Golden Cross Pattern Definition Larger Charts for S&P500 & DJIA |

|

|

|

||

| Best CD Rates with FDIC |

Golden Cross Pattern Definition Larger Charts for S&P500 & DJIA |

|

|

|

||

|

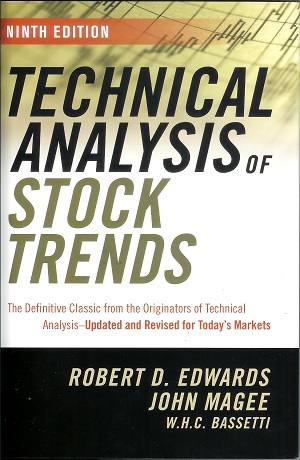

Definition

of the "Golden Cross" pattern:

A golden crossing occurs when the shorter-term 50-day moving average,

MA(50) in the chart below, crosses the longer term 200-day moving

average, MA(200).

These patters usually confirm major changes of market direction.

|

|

|

Typically, it is a

bullish signal for stocks when the

50-DMA crosses above the 200-DMA. Likewise, it is typically a

bearish signal for sotkcs whe the 50-DMA crosses below

the 200-DMA.

More on chart patterns:  The

Bible for technical analysis, Technical Analysis of Stock Trends, The

Bible for technical analysis, Technical Analysis of Stock Trends, by Robert Edwards and John Magee Chapter 6 "Important Reversal Patterns" has many examples and details about the important "Head-and-shoulders" reversal pattern. Chapter 7 "Important Reversal Patterns - Continued" starts out with the "Head-and-Shoulders Bottom" reversal pattern. |

|

How to Get the Best CD Rates |