| Best CD Rates with FDIC |

The Taylor Rule Definition |

|

|

|

||

| Best CD Rates with FDIC |

The Taylor Rule Definition |

|

|

|

||

|

The Taylor

Rule[1] is a formula

named for its inventor, Stanford economist John Taylor that helps

central banks set short term interest rates. The Federal Reserve

Bank of San Francisco says, "real" short-term interest rates (the

interest rate adjusted for inflation) should be determined according to

three factors:

The rule “recommends” lower interest rates ("easy" money) when inflation is below its target or when the economy is below its full employment level.. Sometimes these goals are in conflict: for example, today inflation is well above its target while the economy is below full employment. In this case, the rule provides guidance to Fed policy makers on how to balance these competing considerations when they meet to set rates.

From Wikipedia:

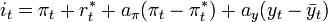

In

this equation, it is the target short-term nominal interest rate (e.g.

the federal funds rate in the US), πt is the rate of inflation as

measured by the GDP deflator, |

|

|

[1] Taylor, John B. 1993. "Discretion Versus Policy Rules in Practice," http://www.stanford.edu/~johntayl/Papers/Discretion.PDF Highest CD Yields with FDIC Definition: A Certificate of Deposit or CD is certificate from a bank stating that the named party has a specified sum on deposit, usually for a given period of time at a fixed rate of interest. Often there is a penalty for early withdrawal (taking your money out before the specified period of time.) |

| For

Best Advice Sitemeter |

Money

Sitemeter |

To

advertise on this page, please contact advertising"at"forbestadvice.com |