|

TIPS

Fixed and Adjustable Rates Treasury-Inflation Protected Securities |

|

|

|

||

*==> Very Best CD Rates with FDIC <== * |

||

|

Treasury-Inflation

Protected Securities, also known as TIPS,

are securities whose principal is tied to the Consumer Price Index.

With inflation, the principal increases. With deflation, it decreases.

When the security matures, the U.S. Treasury pays the original or

adjusted principal, whichever is greater.

TIPS pay interest every six months, based on a fixed rate applied to the adjusted principal. Each interest payment is calculated by multiplying the adjusted principal by one-half the interest rate. Follow the links below to view detailed data on the CPI numbers for various time periods. (from TreasuryDirect.gov)

|

|

||||

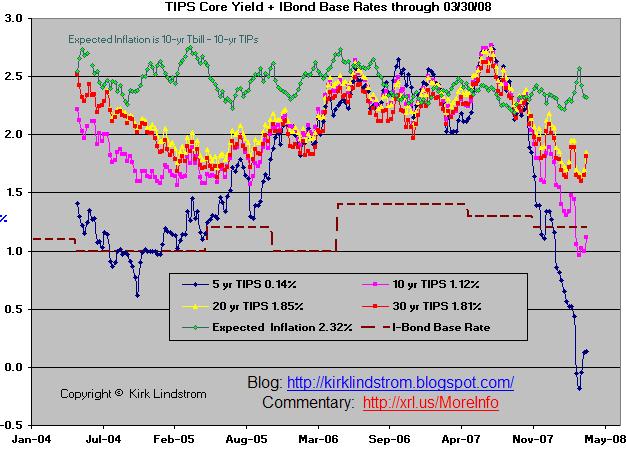

| Chart of Base Rates for TIPS and IBonds (Click chart to see it full sized)  This chart is updated monthly in Kirk Lindstrom's Investment Letter. (more info & Free Sample) TOP OF PAGE |

|||||