|

ISE Sentiment

Indicator International Securities Exchange |

|

|

|

||

| Key Sentiment Indicators |

||

|

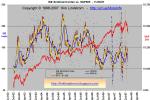

Charts of the International

Securities Exchange (ISE) Sentiment Index plotted versus the Dow Jones

Industrial Average (DJIA chart),

S&P500 (chart)

and NASDAQ composite index (COMPQ chart) are

key sentiment indicators for stock market technical analysis.

Contrarian theory states the time to buy is when fear and pessimism is

at a maximum since this usually occurs near market bottoms.

According to the ISE web site (http://www.ise.com/): The ISE Sentiment Index is a unique put/call

value that only uses opening long customer transactions to calculate

bullish/bearish market direction. Opening long transactions are thought

to best represent market sentiment because investors often buy call and

put options to express their actual market view of a particular stock.

Market maker and firm trades, which are excluded, are not considered

representative of true market sentiment due to their specialized

nature. As such, the ISEE calculation method allows for a more accurate

measure of true investor sentiment than traditional put/call ratios.

For a current reading on what the ISE sentiment index charts and many other sentiment indicators mean, subscribe to Kirk Lindstrom's Investment Newsletter. |

|