|

State

Street Investor Confidence Index Investor Sentiment |

|

|

|

||

| Key Sentiment Indicators |

||

|

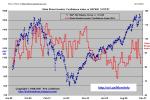

Charts of the State

Street Investor Confidence

Index plotted versus the Dow Jones Industrial Average (DJIA), S&P500

and NASDAQ composite index (COMPQ) are

key sentiment indicators for stock market technical analysis.

Contrarian theory states the time to buy is when fear and pessimism is

at a maximum since this usually occurs near market bottoms.

According to State Street, the “State Street Investor Confidence Index® measures the attitude of investors to risk. Developed by Harvard Professor Ken Froot and State Street Associates Director Paul O'Connell, the Index uses the principles of modern financial theory to model the underlying behavior of global investors. Unlike other survey-based confidence measures that focus on expectations for future prices and returns, the Index provides a quantitative measure of the actual and changing levels of risk contained in investment portfolios representing about 15% of the world's tradable assets.” |

|

|

For a current reading on

what these sentiment indicators mean,

subscribe to Kirk Lindstrom's Investment Newsletter.

DISCLAIMER:

Answers and our words are general in nature, are not meant as specific

investment advice, and do not necessarily represent the opinion of

anyone but forbestadvice.com.

Individuals should consult with their own advisors for

specific investment advice

Top of Page |