|

Bob Brinker's Advice for New Money with Marketimer Quotes Select quotes from various issues of Marketimer from January through July 2014 |

|

|

|

||

| September 2, 2014 Article Bob Brinker Fan Club Home Page |

||

|

|

How to Invest what Bob Brinker calls "New Money"

This

weekend, on Sunday August 31, 2014, a caller to "Moneytalk with Bob

Brinker" named Frank asked the guest hostess, Neale Godfrey the

following:

"I have been dollar cost averaging money into the market for years. And fortunately, I have come into some new – $200,000. I have been waiting patiently, as Bob has expressed in weeks and months past. But not having invested, I feel like I have lost out in the run-up of the market… Do I start putting this money into the market now – over what time frame would you recommend?"Godfrey didn't give an actionable answer. In fact, it was a pretty worthless reply. Perhaps she was told she would lose this job if she said anything that made Bob Brinker look bad so she elected to ramble and say nothing useful. One of our readers commented on the question at Silicon Investor1 with the following quotes from recent issues of Bob Brinker's monthly Marketimer newsletter: I think Frank in New York demonstrates that Bob Brinker's advice to "dollar cost average ON WEAKNESS" has kept many subscribers and listeners out of the market. Weakness has not arrived, and many Marketimer subscribers have remained out of the market with substantial amounts of money. It goes further than Brinker just implying that subscribers should NOT invest until weakness appears. He says it in so many ways:

|

|||

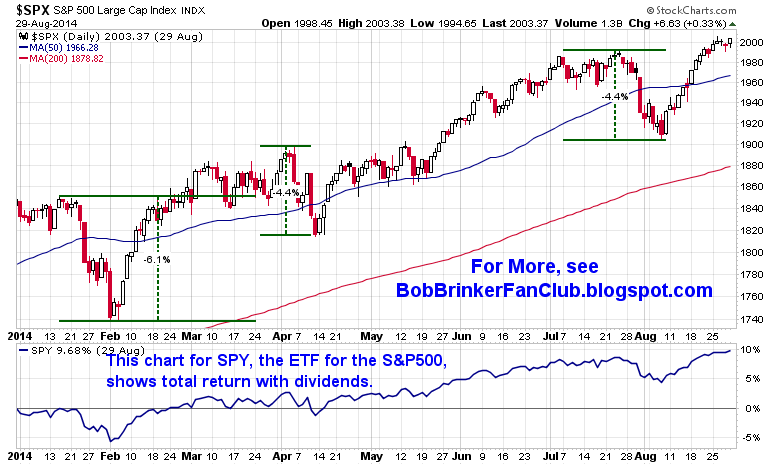

Year to date, the S&P 500

is up 9.89%. But Frank in New York has $200,000 on the sidelines, not

benefiting from the 9.89% run up. Waiting for weakness.

Chart of S&P500 YTD

Frank says "I have been waiting patiently, as Bob has expressed in weeks and months past. But not having invested, I feel like I have lost out in the run up of the market."

Is it any wonder that Rich has kept his $200,000 out of the market, waiting for weakness? That is the ONLY sensible thing Rich (Frank?) could do, based on Bob Brinker's general tone and comments about the market. He may say in the Marketimer that he is fully invested, but his subscribers are not fully invested. Brinker has had a "We are NOT enthusiastic" opinion about the stock market for quite some time now. And this has kept subscribers out of the market. And what about new subscribers over the past several years? Do you think they are fully invested? Why would they be, when their team captain and chief cheerleader is worried, "vigilant with regard to our stock market indicators", "not enthusiastic"......investors are "complacent".......we are going to have a "correction" Any sensible person with any degree of risk aversion, taking Bob Brinker's advice, will have stayed out of the stock market. Frank in New York is probably closer to the norm rather than the exception. ETF1 Robert 9/2/14 Editor's notes: Bob Brinker's model portfolios remain fully invested with no change in the September newsletter. We suspect he will issue a "special bulletin" if the market has one of these anticipated corrections. A 10% correction from the recent top would take the market just below 1,800. Despite Brinker's advice to be fully invested, many of his fans have significant cash in low yielding money market accounts at their broker while they wait for Brinker's "Buying Opportunity." We recommend moving the cash to an online savings account with FDIC insurance that pays nearly 1% while you wait for his "buying opportunity." When you decide to invest this money in stocks, you can transfer the cash electronically back to your discount broker. We do this with our own money on taxable accounts.

|

||||

| Top of Page | ||||

|

|||

|

|

|||

| Sitemeter

|

Fan

Club Sitemeter |

bbfc

sitemeter |

To

advertise on this page, please contact advertising@<REMOVE>forbestadvice.com |