|

Effect

of QQQ Advice on Portfolio Returns Estimate of Effect of Bob Brinker's QQQ advice on his Reported Model Portfolio Returns |

|

|

|

||

Bob Brinker Fan Club Home Page |

||

|

This

article examines the effect of Bob

Brinker's QQQ Advice on his model portfolios.

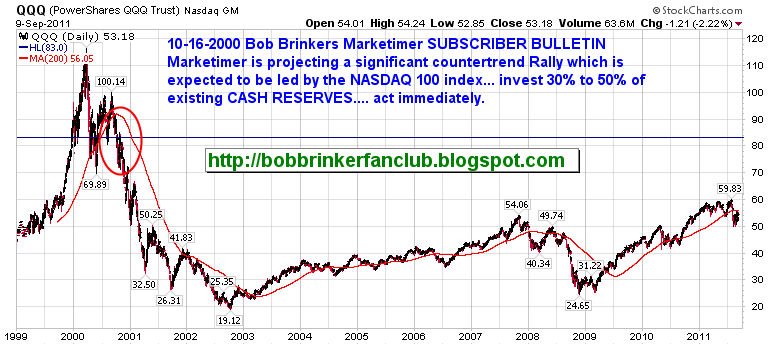

In Jan 2000 Brinker moved 60% of his equity portfolios to cash. In August 2000 he moved another 5% to cash for a total of 65% in cash reserves. He told subscribers to wait for instructions on how to use these cash reserves. If he had stayed there, this move would have looked brilliant. But, the story is only beginning. On October 16, 2000, Brinker’s subscribers got a special bulletin vial USPS mail advising the they could"Act Immediately" and buy QQQ (the exchange traded fund for the NASDAQ100 index) in anticipation of a 2 to 4 months "counter trend rally" for a 20% or more gain. Confused callers to the Marketimer office were told "Bob is comfortable with QQQ at $86" by office staff. You can read the rest of what happened at Bob Brinker's QQQ Advice but basically the QQQ(Q) fell from a high of $87 to just under $20 and Bob held all the way down. This was not reflected in his model portfolios where he kept the 65% cash reserves in cash, thus having it both ways. In the October 2000 bulletin, Brinker recommended 30 to 50% of cash reserves be put into QQQ(Q) for his aggressive (Model Portfolio #1) subscribers. The average price for the week after the bulletin was sent was about $82.

Reported P1 money market allocation on 2/28/2003 : $102,716

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Since

the money market balance includes the accumulated interest, removing

half of the ending balance from the March 2003 total automatically

takes into account the loss in interest. This reduces the money market

balance by $51,358.

QQQ

closed at about $24 on the day the second bulletin was issued, and

again on the next day. Since Brinker's new P1 recommendations were all

mutual funds, the closing price is the one he had to use in calculating

his reported results. PRICES for QQQ

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

The reported balance for P1 on 2/28/2003 was $126,712. We need to subtract the half of the money market fund that was used to buy QQQ and replace it with what was left of the QQQ holding.

Conclusion: I calculate the QQQ advice caused Brinker's reported total to drop by 29% and his APR to drop 2.0% a year such that his portfolio under performs the buy and holders of the Wilshire 5000 by 1.3% per year since the inception of P1. |

|

|||

|

|

|||

| Sitemeter

|

Fan

Club Sitemeter |

bbfc

sitemeter |

To

advertise on this page, please contact advertising@<REMOVE>forbestadvice.com |