|

Bob Brinker Moneytalk Summary November 6, 2011 Radio Show Key Topics: Bob Brinker 2011 to 2012 Market Outlook |

|

|

|

||

| Bob

Brinker Fan Club Home Page November 6, 2011 Moneytalk Summary with Editorial Comment by Kirk Lindstrom |

||

|

Recession

Dome - Two men enter, one man leaves

On Sunday November

6, 2011 Bob Brinker once again entered the

"Recession Dome" with The Economic Cycle

Research Institute's (ECRI) managing

director and my friend, Lakshman

Achuthan. Bob didn't mention ECRI or

Lakshman by name, but on September 30, 2011

ECRI went public with their call for a new

recession:

==> Sept 30, 2011 Jobs To Get Worse Under Recession-Bound U.S. EconomyBob was adamant that he is not predicting a recession, that these forecasters are wrong and they will owe him an aploogy! Brinker said:

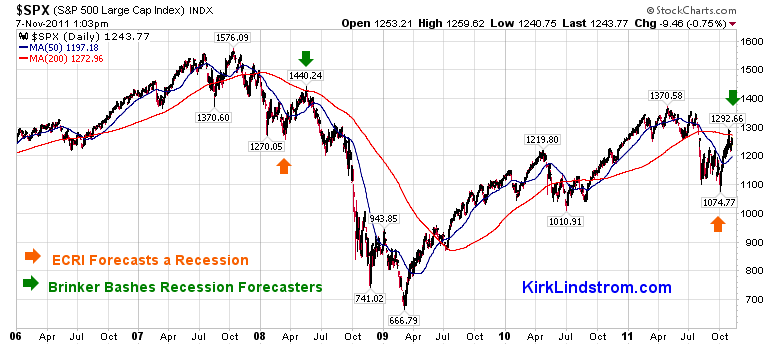

==> 03/28/08: ECRI Calls it "A Recession of Choice"Back in 2008 Bob Brinker was bullish on US stocks and the US economy. Note how similar it was then to now on the graph below and explained in the text that follows. Top of page

Graph of the S&P500 from January 1, 2006 through November 7, 2011  MA(50) = 50 day moving

average is blue line

on the above graph

MA(200) = 200 day moving average is red line on the graph Note how

Right now it is too early to tell FOR SURE if the US will enter a recession and who will ultimately be right this time. Given how wrong Brinker was in 2007 and 2008 with his prediction the US economy would grow and the stock market would reach the 1600s, it seems a good idea to use periods of strength to take a few chips off the table so you have fund to buy if the market goes down. If the market goes up, you would still participate. Market

Update: Bob Brinker remains fully

invested.

That is not the case for my

explore portfolio. Unlike Brinker, I

took profits near the highs this year and

raised a lot of cash. Then I put that

cash to work near the lows for the year.

Then the market rallied and I sold a good deal

of what I bought during the market weakness so

I'm ready to do it again yet will profit

nicely if the market goes higher. Here

are what some of my subscribers sent me via

email recently:

|

||

|

Learn

the

"Core and Explore" approach to investing

with "Kirk Lindstrom's

Investment Letter"

More

information - My

returns by YearGuess why Brinker doesn't advertise HIS returns by year! Subscribe

NOW and get

the November 2011 Issue

for FREE! !

(Your 1 year, 12 issue subscription will start with next month's issue.)

|

||

|

||

|

September

11,

2011 MONEYTALK GUEST

Bob's third hour guest was Rachael Emma Silverman, author of |

||

| If you want updates on what Brinker is saying on Moneytalk delivered to your email box, often within 24 hours after Sunday's show, then send us a note at TalkAboutMoney@gmail.com and ask to get on our mailing list. | ||

| Top of Page | ||

|

|||

|

|

|||

| Sitemeter

|

Fan

Club

Sitemeter |

bbfc

sitemeter |

To

advertise

on this page, please contact advertising@<REMOVE>forbestadvice.com |