|

Bob Brinker Marketimer

Bulletin History Special Subscriber Messages between Marketimer Newsletters |

|

|

|

||

|

Bob Brinker will

occasionally use special bulletins to share information

or what he calls a "Special Subscriber Message" with his

Marketimer subscribers between regular issues of his

newsletter. These bulletins are rare and sometimes

advise buying or selling equities. Below is a

brief history of Bob Brinker's bulletins.

Bob

Brinker

Fan Club Home Page |

||

|

|

October 16,

2000: The very first special

bulletin was sent via email to his subscribers

in October 2000. Many complained that it

took several weeks to get their bulletins in the

snail mail. Someone in the Marketimer

office said they had over 200,000 of these to

get out so there were some delays. We

believe these major delays and the added cost of

postage and handling led Bob Brinker to start

announcing "Special Subscriber Messages" on a

newly created "Bulletin Site" on his web site he

created for his next special bulletin. You

can see an actual copy of the October 2000

bulletin at Detailed

summary

of Bob Brinkerís QQQQ Advice.

March 11, 2003: With the DJIA at 7568.18 and S&P500 at 807.48, Bob Brinker recommended his subscribers return to a fully invested position in the stock markets. He increased his model portfolios 1 and 2 to 100% equities and portfolio #3 to 50% equities. As of September 25, 2011, he has not rebalanced P3 while P1 and P2 have remained fully invested in equities since March 11, 2003. This was one of his best ever market timing calls. Of course, if you held QQQs you were not impressed that he ignored it. March 19, 2007: Marketimer Special Subscriber Message: We are very pleased with the stock market correction progress that has unfolded in recent weeks. As a result, we now rate the stock market as attractive for purchase on any weakness that may occur in the vicinity of the S&P500 Index 1380 level or lower. [S&P500 was 1,386.95 the night before this bulletin was published. August 16, 2007: S&P 500 Index close at 1411.27. Brinker wrote: "In our view, the stock market is currently in the process of forming the area of the S&P 500 Index correction low for calendar year 2007... The Marketimer © stock market timing model © is currently in highly favorable territory. Any further testing of the area of the correction lows, which we expect to be close to the current S&P 500. Index level, is regarded as an additional buying opportunity for subscribers looking to add to stock market holdings. Marketimer © expects the S&P 500 Index to register new historic record highs as we move forward into next year. November 5, 2007: Regular Marketimer update with S&P500 at 1549.38. Brinker wrote, "The S&P500 index should rise at least into the mid-1600's range next year, in our view....... We continue to rate the stock market as attractive for purchase on any weakness into the area of the S&P500 Index mid-1400s, in the event such weakness occurs... All Marketimer model portfolios remain fully invested..." (Note this was not a bulletin but this explains what "exceeded our expectations" in his next bulletin. |

|

|

January 20,

2008: S&P 500 Index @ 1325.19.

Brinker wrote, "Recent stock market weakness

has exceeded our expectations. The

S&P 500 Index has declined 15.3% from its

record closing high of 1565.15 registered on

October 9, 2007. Investor confidence has been

shaken by news of huge mortgage related losses

at major Wall Street banking and brokerage

institutions, along with concern about

economic growth in 2008 as consumers struggle

to pay high energy bills and deal with the

fallout from the housing

recession... We recommend a

dollar-cost-average approach for new stock

market investing until a definitive bottom

area is established...."

February 10, 2008: S&P 500 Index @ 1331.29 Brinker wrote, "Marketimer views the establishment of a correction bottom as a process which unfolds over a given period of time..... We now rate the stock market attractive for purchase on any weakness that occurs in the current area of the S&P 500 Index low 1300's, or any minor weakness that occurs below that level... We regard any additional testing and probing in this S&P 500 Index price range as an opportunity to purchase equities at what we regard as bargain level prices." September 16, 2008: S&P 500 Index @ 1213.60. Brinker wrote, "We recommend dollar-cost averaging for new stock market money at this time, pending the development of a definitive area of stock market stability... There are no changes to our model portfolios." January 15, 2009: Brinker wrote, "We regard any weakness in the low-to-mid 800's S&P 500 Index price range as an opportunity to buy into the stock market at favorable price levels." As we noted above, Bob Brinker's model portfolios were FULLY INVESTED since March 2003 so these bulletins did little other than encourage subscribers to hold all the way down through the eventual S&P500 intraday bottom of 666. He had no buy bulletins in the 600s or 700s.... He gave on in the 800s but I'm not sure if the market had any "weakness" to buy after he issued it. On the radio, he brags about a buy signal at 1030 he gave in his newsletter so I assume there was no weakness in the 800s he was able to capture. August 12, 2011: There was a note on the bulletin site saying there was no bulletin. We think he sent out a bulletin to past and present subscribers to drum up interest in subscribers unhappy he was fully invested since March 2003 and missed the bear market in 2008 and 2009 with "buy signals" most of the way down starting with a "Gift Horse Buying Opportunity" in the mid 1400s issued when the market was in the 1500s. We made fun of it on a blog post so a few days later we noticed.... August 16, 2011: The message was changed to "Special Subscriber Message is available by clicking on the "Special Subscriber Message (August 10) at the homepage. When we followed the message, we were led to a page dated August 9th with a special URL that reiterated that Brinker was still bullish with no changes to his model portfolios. His advice was to dollar cost average on "market weakness" into equities. We wonder what model portfolio money subscribers who followed his advice could use to buy more equities given he advice was to be 100% in equities since March 2003! On August 10, 2011 the S&P500 closed at 1120.76 click for FREE ISSUE of The

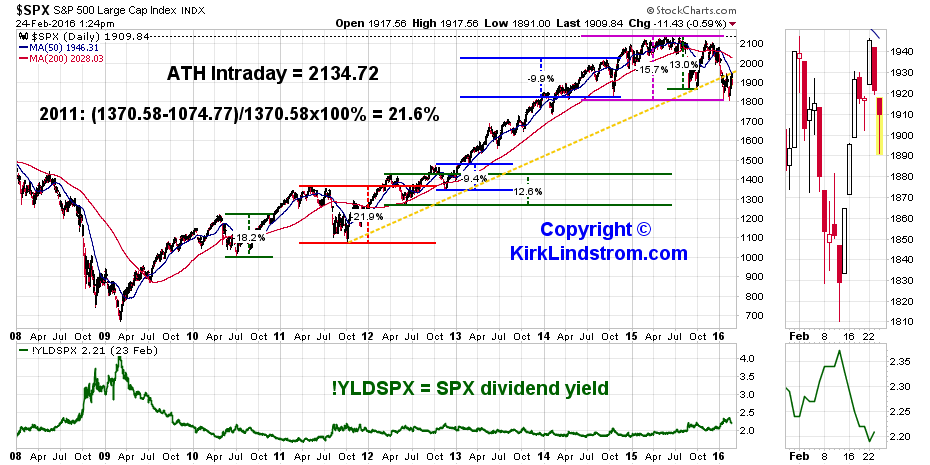

Retirement Advisor newsletter

September 22, 2011: S&P 500 Index @ 1,129.56. There was a new special bulletin posted. He did not give advice to sell. Given he was fully invested since March 2003, does it really matter what he wrote? So as to not upset those who pay for this nonsense, we'll not give specific details until the information is stale or he discusses it on his weekly radio show. February 11, 2016: Buy signal issued while fully invested. See Market Timer Bob Brinker's Special Bulletin

Article: How to Get the Best CD Rates |

||

|

|||

|

|

|||

| Sitemeter

|

Fan

Club

Sitemeter |

bbfc

sitemeter |

To

advertise

on this page, please contact advertising@<REMOVE>forbestadvice.com |