|

August 6 Market Update - July 31st Advice Bob Brinker's Recent Advice to not Sell |

|

|

|

||

| Bob

Brinker Fan Club Home Page - Moneytalk

Guest July 31, 2011 Moneytalk Summary with Editorial Comment ("EC") by Kirk Lindstrom |

||

|

July 31, 2011 Moneytalk Update:

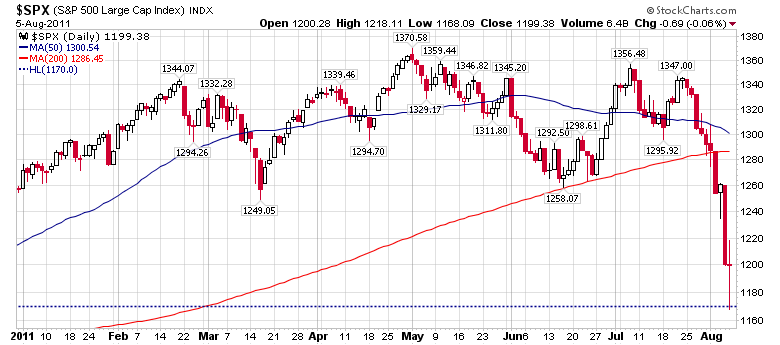

Bob Brinker remains fully invested. Last Sunday, July 31, 2011, Bob Brinker said it was amazing how the stock market had taken all of the debate over the debt ceiling in stride. He said the S&P 500 was "setting about 5% below its closing high for the year, which is truly amazing." EC: The closing high for the year for the S&P500 is $1,363,61 on April 29, 2011. You can move your mouse along this S&P500 chart to read the closing highs by date. Friday the market closed at 1199 (See Market Update below) for a decline of 12.0% from the April 29 closing high. Bob Brinker's Marketimer newsletter portfolios #1 and #2 have been 100% equities (fully invested) since March 2003. See Bob Brinker's Asset Allocation History Bob Brinker said that back in June, there was a caller who asked him if he should get out of the market when it was at 1270 to wait for the dust to settle over this debt ceiling issue. Brinker said the market was at 1292 and if that individual had sold out, he would now be faced with either sitting and waiting it out or buying it at higher levels. Bob said he was taking advantage of dollar cost averaging weakness lately and in fact bought some more into the market on Friday (July 29, 2011). Of course, the market is now at 1292, a couple of percent higher than when that call came in at the end of June. So this is what happens. If that individual would have sold out at 1270 at that time, he would be faced now with either sitting it out or re-entering at a higher level.Bob Brinker went on to say he was not part of the "panic crowd" and said he has repeated over and over all summer that he did not believe the US would default on its debt obligations and this is exactly how it looks like it will work out. Historical Price Data for $SPX, the S&P 500 Large Cap Index Day Date Open High Low Close Volume |

|

|||||||||||||||||||||||||||||||||||||||||

|

EC:

I am sure glad I wasn't 100% in stocks like Bob Brinker. I

lowered my

asset allocation to equities just before the market top and have made

many buys since the market dropped below 1270. I had an "auto

buy"

(limit order placed ahead of time) in my newsletter "explore portfolio"

trigger Friday (8/5/11) for SPY at $117. This is roughly 1170 for

the

S&P500 or 122 points lower than just last week's 1292!

August 6, 2011

Market Update:SPY is the exchange traded fund, ETF, for the S&P500: SPY Charts and Quote

S&P500 YTD with my "auto buy" level shown with a dashed blue line

Article: How to Get the Best CD Rates |

||||||||||||||||||||||||||||||||||||||||||

| MONEYTALK

GUEST Bob had on Vito Tanzi to discuss his book, "Government versus Markets: The Changing Economic Role of the State." |

||

| If you want updates on what Brinker is saying on Moneytalk delivered to your email box, often within 24 hours after Sunday's show, then send us a note at TalkAboutMoney@gmail.com and ask to get on our mailing list. | ||

| Top of Page | ||

|

|||

|

|

|||

| Sitemeter

|

Fan

Club Sitemeter |

bbfc

sitemeter |

To

advertise on this page, please contact advertising@<REMOVE>forbestadvice.com |