| Series I Bonds

Explained (iBonds) Inflation Protected Bonds The "i" is for "inflation" - Where Do I Buy I Bonds? Earning Rates for Older I-Bonds - I Bond Rate History |

|

|

|

|

||

|

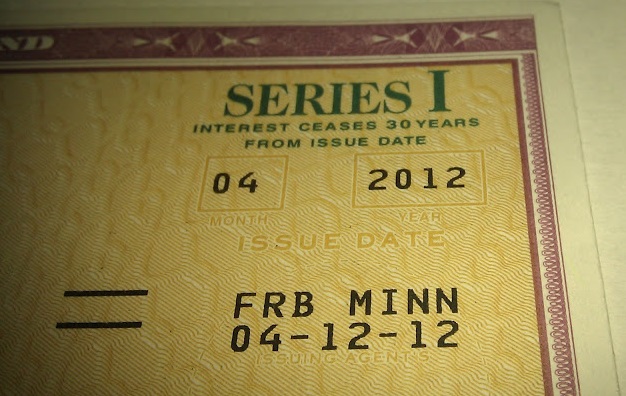

Series I Bonds

are a low-risk, liquid savings product.

While you own them they earn interest and

protect you from inflation.

Earnings rates for I bonds are set each May 1 and November 1. Interest accrues monthly and compounds semiannually. Bonds held less than five years are subject to a three-month interest penalty. I Bonds have an interest-bearing life of 30 years. When the inflation rate is less than zero, a bond's earnings rate is less than its fixed rate (but the earnings rate is never less than zero) November 2, 2015 Update: The Current I Bond Composite Earnings Rate is 1.64% with a Fixed Rate of 0.10%. For rates on I Bonds bought before this period, see:

The earnings rate combines a 0.00% fixed rate of return with the 1.48% annualized rate of inflation as measured by the Consumer Price Index for all Urban Consumers (CPI-U). The CPI-U increased from 236.293 in March 2014 to 238.031 in September 2014, a six-month increase of 0.74%.

More about

Series I Bonds

Best Time to Buy I Bonds: Near the end of the month. Make sure you leave enough time for funds to clear. Best Time to Sell I Bonds: At the start of the month since interest for the prior month is computed on the first of each month. You don't earn interest for fractional months so sell only after the new interest shows up in your account, usually the first of the month, I Bond Composite rate = [Fixed rate + (2 x Inflation rate) + (Fixed rate x Inflation rate)]

Where to Buy I Bonds? You may purchase I Bonds at www.TreasuryDirect.gov. |

|

|

|

| TOP OF PAGE Highest CD Rates |