|

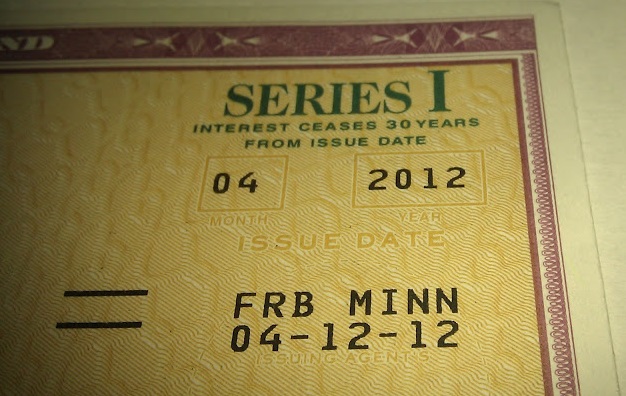

I Bond Rates (iBonds) Inflation Protected Bonds Composite Rates for Older Series I Bonds |

|

|

|

||

Current I-Bond Rates - iBond Base Rate History |

||

November 2, 2015 Announcement: Today the Bureau of the Public Debt announced earnings rates for Series I Savings Bonds and Series EE Savings Bonds, issued from November 2, 2015 through April 30, 2016. Read about it at "Current Series-I Bond Interest Rates."

The earnings rate for Series I Savings Bonds is a combination of a fixed rate, which applies for the life of the bond, and the semiannual inflation rate. For the next six months, the earnings rate combines a 0.10% fixed rate of return with the 1.54% annualized rate of inflation as measured by the Consumer Price Index for all Urban Consumers (CPI-U). ==>Thus, the current I Bond Composite Earnings Rate is 1.64% with a fixed rate of 0.10% ==> Composite Rates for Older Series I Bonds ==> More information at New Series I Bonds Offer Attractive Rates, a Seeking Alpha Article |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Articles Beware

of

Annuities

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||